IWF: iShares Russell 1000 Growth ETF Stock Price, Quote and News

Contents:

Sign Up NowGet this delivered to your inbox, and more info about our products and services. ETF Database’s Financial Advisor Reports are designed as an easy handout for clients to explain the key information on a fund. View charts that break down the influence that fund flows and price had on overall assets. The $728.7 million QQQJ, which turns three years old in October, was among several mid-cap ETFs highlighted by Chronert.

Checking in on Factor ETF Performance etf.com – etf.com

Checking in on Factor ETF Performance etf.com.

Posted: Thu, 13 Oct 2022 07:00:00 GMT [source]

You could choose one stock, a dedicated sector ETF, or a well-diversified fund like USMV. Health Care is at 20%, followed by Technology (16%), Consumer Staples (13%), and Financials (13%). Energy stocks traditionally decline in recessions, so I’m pleased to see almost no exposure here. Real Estate might also come under pressure, as it did in the Subprime Crisis when VNQ lost 65% between November 2007 and March 2009. Finally, Materials exposure is limited to eight stocks totaling 3%.

Business Involvement metrics are only displayed if at least 1% of the fund’s gross weight includes securities covered by MSCI ESG Research. The iShares Russell 1000 Growth ETF seeks to track the investment results of an index composed of large- and mid-capitalization U.S. equities that exhibit growth characteristics. This month, you’ve likely seen dozens of articles on what stocks offer the most recession protection. Chances are all make compelling cases, but only some will prove correct. You might choose the ones that make the best arguments, but this approach ignores the critical objective of purchasing portfolio insurance.

Invesco NewsMORE

To view information on how the ETF Database Realtime Ratings work, click here. IShares Russell 1000 Growth ETF , formerly iShares Russell 1000 Growth Index Fund, is an exchange-traded fund . The Fund seeks investment returns that correspond generally to the price and yield performance of the Russell 1000 Growth Index . The Index measures the performance of equity securities of Russell 1000 index issuers with relatively higher price-to-book ratios and higher forecasted growth. The Fund seeks investment returns that correspond generally to the price and yield performance, before fees and expenses, of the Index. The Index measures the performance of the large-capitalization growth sector of the US equity market.

I/we have a beneficial long position in the shares of SPY, BRK.B either through stock ownership, options, or other derivatives. The Index page provides additional performance information, noting how it launched on June 2, 2008. There were two other significant drawdowns not included in the table above since SPY’s 1993 launch. The first was between September 2000 and September 2002, when SPY declined by 44.71%. The Index fell 25.16% during this period, a 19.56% fee-adjusted outperformance. The second was SPY’s 50.80% decline between November 2007 and February 2009.

Some funds may be based on or linked to MSCI indexes, and MSCI may be compensated based on the fund’s assets under management or other measures. MSCI has established an information barrier between equity index research and certain Information. None of the Information in and of itself can be used to determine which securities to buy or sell or when to buy or sell them.

After reading, I hope to convince you why USMV is an excellent choice you can rely on if recession concerns grow. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data. The Parent Pillar is our rating of IWB’s parent organization’s priorities and whether they’re in line with investors’ interests. The Process Pillar is our assessment of how sensible, clearly defined, and repeatable IWB’s performance objective and investment process is for both security selection and portfolio construction. As a global investment manager and fiduciary to our clients, our purpose at BlackRock is to help everyone experience financial well-being.

iShares Russell 1000 Growth ETF

The adjacent table gives investors an individual Realtime Rating for IWF on several different metrics, including liquidity, expenses, performance, volatility, dividend, concentration of holdings in addition to an overall rating. The “A+ Metric Rated ETF” field, available to ETF Database Pro members, shows the ETF in the Large Cap Growth Equities with the highest Metric Realtime Rating for each individual field. To view all of this data, sign up for a free 14-day trial for ETF Database Pro.

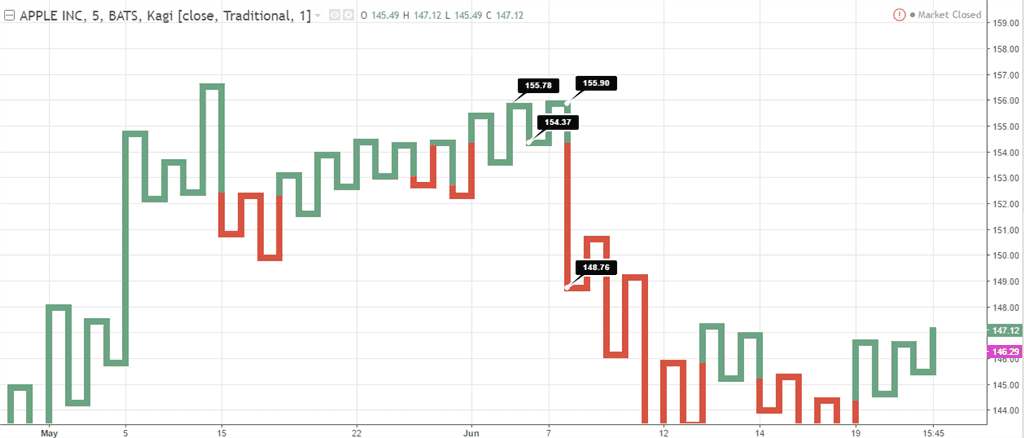

USMV launched in October 2011 after the Great Financial Crisis, so its history is limited. However, the drawdown tables below highlight how it outperforms SPY in bear markets. From January to September 2022, USMV declined by 17.35% compared to 23.93% for SPY, a 6.58% beat. Except for the COVID-19 decline, which matched SPY, USMV experienced no other significant losses. Information is provided ‘as is’ and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use, please see disclaimer.

- Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed.

- One-third is Newmont , a gold producer that produced a flat return when SPY declined by 19% in Q1 2020.

- This article will take you through its historical performance, including Index data to 1988, and evaluates in detail its fundamentals at the industry level.

- This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting.

- I put together this table comparing USMV’s fundamentals with the 11 sector ETFs offered by State Street.

The following charts reflect the geographic spread of IWF’s underlying holdings. In the case of QQQJ, smaller, relatively speaking, could be better because some experts see underappreciated opportunity in the mid-cap arena. Dow Jones Industrial Average, S&P 500, Nasdaq, and Morningstar Index quotes are real-time. To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Holdings

BlackRock provides compensation in connection with obtaining or using third-party ratings and rankings. Climate change is one of the greatest challenges in human history and will have profound implications for investors. To address climate change, many of the world’s major countries have signed the Paris Agreement.

They total 76% of the portfolio, and this view touches on several critical factors, including USMV’s lower beta, a slight lean towards dividend-paying stocks, and solid profitability and earnings revision scores. ETF Database analysts have a combined 50 years in the ETF and Financial markets, covering every asset class and investment style. The team monitors new filings, new launches and new issuers to make sure we place each new ETF in the appropriate context so Financial Advisors can construct high quality portfolios.

You need high certainty that the strategy will work to some meaningful degree, and I don’t think most individual stocks offer that comfort. USMV’s standout metric is its 0.70 five-year beta, indicating it’s approximately 30% less volatile than SPY. Except for IT Consulting & Other Services and Semiconductors, all industries have betas below market. USMV accomplishes this low beta by underweighting or outright avoiding stocks like Apple , NVIDIA , Meta Platforms , and Tesla . Choosing a diversified fund like USMV is crucial for investors buying recession insurance.

Equity

This fund does not seek to follow a sustainable, impact or ESG investment strategy. The metrics do not change the fund’s investment objective or constrain the fund’s investable universe, and there is no indication that a sustainable, impact or ESG investment strategy will be adopted by the fund. For more information regarding the fund’s investment strategy, please see the fund’s prospectus. USMV’s 7.85% estimated earnings growth rate aligns with SPY’s 7.90%.

Large-Cap Growth Leads SPX Lower In August, Nervous Investors … – Seeking Alpha

Large-Cap Growth Leads SPX Lower In August, Nervous Investors ….

Posted: Wed, 31 Aug 2022 07:00:00 GMT [source]

While a slew of https://1investing.in/ traded funds offer exposure to smaller stocks with growth profiles, investors have long embraced large- and mega-cap equivalents. Business Involvement metrics are calculated by BlackRock using data from MSCI ESG Research which provides a profile of each company’s specific business involvement. BlackRock leverages this data to provide a summed up view across holdings and translates it to a fund’s market value exposure to the listed Business Involvement areas above. However, that doesn’t mean investors can’t locate compelling growth opportunities outside of the large/mega-cap arena.

The People Pillar is our evaluation of the IWF management team’s experience and ability. Get our overall rating based on a fundamental assessment of the pillars below. This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply. Detailed Holdings and Analytics contains detailed portfolio holdings information and select analytics. Where data is not available, and / or if data changes, the estimation methods vary, particularly those related to a company’s future emissions.

As a result, BlackRock publishes MSCI’s ITR metric for its funds in temperature range bands. The bands help to underscore the underlying uncertainty in the calculations and the variability of the metric. Equity ETFs and aim to provide you with the most comprehensive ETF coverage on Seeking Alpha.

The an introduction to swaps estimates a fund’s alignment with the Paris Agreement temperature goal. However, there is no guarantee that these estimates will be reached. The ITR metric is not a real time estimate and may change over time, therefore it is prone to variance and may not always reflect a current estimate.

Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. Standardized performance and performance data current to the most recent month end may be obtained by clicking the “Returns” tab above. The Hypothetical Growth of $10,000 chart reflects a hypothetical $10,000 investment and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses were deducted. USMV now offers the same earnings growth as SPY but for a 3.29-point discount on forward earnings, all while featuring a 0.70 five-year beta that only a handful of sector ETFs can match. It beat SPY by approximately 6% in the 2018 and 2022 drawdowns and saved investors 10% and 20% through the Great Financial Crisis and Dot Com Bubble crashes.

Currencies for the valuation price will be generally determined as of the close of business on the New York Stock Exchange, whereas for the vendor price will be generally determined as of 4 p.m. The calculated values may have been different if the valuation price were to have been used to calculate such values. The vendor price is as of the most recent date for which a price is available and may not necessarily be as of the date shown above. For more information regarding a fund’s investment strategy, please see the fund’s prospectus.

It’s well-diversified at the sector, industry, and company level and optimized to favor low-beta, low-volatile companies with low idiosyncratic risk. Constituents grew sales by 10.49% over the last five years, but analysts estimate just 4.65% sales growth over the next year, with 5.47% EPS growth. The best part is that nearly the entire fund has a perfect “A+” Seeking Alpha Profitability Grade. Quality matters in a recession, but I want to remind readers that Health Care is USMV’s largest sector exposure area. XLP has a low 0.59 five-year beta but offers less earnings growth (6.08%) than USMV and trades at a higher 24.28x forward earnings. Costco trades at 34.51x forward earnings and is 8.70% of the portfolio.

Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund. Other large investors have also made changes to their positions in the company.

Should iShares Russell 2000 Growth ETF (IWO) Be on Your Investing Radar? – Yahoo Finance

Should iShares Russell 2000 Growth ETF (IWO) Be on Your Investing Radar?.

Posted: Wed, 08 Mar 2023 08:00:00 GMT [source]

Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters. The iShares Russell 1000 Growth ETF is designated as “diversified” and the fund intends to be diversified in approximately the same proportion as its underlying index. It may become non-diversified, as defined in the Investment Company Act of 1940, solely as a result of a change in relative market capitalization or index weighting of one or more constituents of its underlying index.

प्रतिक्रिया दिनुहोस्: